Professional Business Valuation

Services to Maximize Your Sale Value

Discover the true worth of your company with our team of business valuation experts. We provide clear, defensible valuations that help business owners sell, exit, or plan with confidence.

Why Business Valuation Matters:

Knowing the true value of your company is more than a number — it’s a roadmap for smart decisions.

Our business valuation services give owners a clear, defensible picture of their company’s worth, helping you make confident choices at every stage.

professional business valuation enables you to:

Sell with confidence

Our experienced business valuation experts help you set the right asking price and negotiate from a position of strength.

Plan your exit strategy

Accurate business valuation for exit planning ensures you time the sale perfectly and maximize returns.

Raise capital or secure financing

Certified business valuation specialists provide lenders and investors with reliable figures that support funding decisions.

Support strategic growth

Leverage dependable corporate valuation insights and M&A valuation services to assess mergers, acquisitions, or restructuring opportunities.

Plan for succession or estate purposes

Work with a professional business appraiser to make ownership transitions smooth and tax-efficient.

Without guidance from a trusted business valuation firm, many owners make costly mistakes—under pricing their company, overestimating value, or missing out on strategic opportunities. Guesswork can leave significant money on the table or even derail a deal.

How We Value Your Business

Our professional business valuation process is designed to give you a clear understanding of your company’s true worth. Here’s a step-by-step look at how our business valuation experts work

We start by learning about your business, your goals, and your industry. During this phase:

We gather key financial statements, tax returns, and operational data.

We discuss your growth plans, exit strategy, or sale objectives.

This step ensures our valuation is customized and accurate for your unique business.

Next, our team carefully examines your financial performance:

Historical revenue, profitability, and cash flow trends are analyzed.

Operational metrics and risk factors are reviewed to understand strengths and weaknesses.

This analysis helps us identify what drives value in your business and highlights opportunities to maximize it.

Every business is unique, so we apply the valuation method that best reflects your situation:

1. Market Approach Valuation

This method determines your business’s worth by comparing it to similar companies recently sold in the market. It’s ideal for business owners looking for a professional business valuation that reflects real-world market conditions.

2. Income Approach Valuation

The income approach estimates value based on your company’s projected earnings and cash flow. This is commonly used for business valuation for selling a business or business valuation for exit planning, helping you set a price grounded in future potential.

3. Asset-Based Valuation

This approach calculates your business’s value by assessing assets and liabilities, including tangible and intangible assets. It’s particularly useful for companies with significant equipment, inventory, or intellectual property.

4. M&A Valuation Services

When planning mergers or acquisitions, our M&A valuation services provide a comprehensive, defensible valuation to support negotiations and deal structuring.

For sellers, our business valuation for selling a business and business valuation for exit planning ensures that the value we provide is realistic, defensible, and aligned with your goals.

Finally, we provide a comprehensive business valuation report that includes:

The calculated value of your business with supporting analysis.

Insights into factors that affect value, such as industry trends or operational efficiencies.

Recommendations to help you prepare for a sale, raise capital, or plan your exit strategy.

This step ensures you have all the information needed to make confident, informed decisions about your business’s future.

What Makes Us Different

Choosing the right partner for a business valuation can make all the difference. At Horizon M&A, our business valuation experts go beyond numbers to deliver insights, guidance, and results tailored to your goals.

Expertise You Can Trust

Our team includes certified professional business appraisers with years of experience in M&A, exit planning, and corporate advisory. You get a valuation that is accurate, defensible, and actionable.

Tailored & Comprehensive Approach

We understand that every business is unique. That’s why we customize our business valuation services to your industry, size, and strategic objectives — whether you’re planning to sell, raise capital, or exit.

Clear & Actionable Insights

We understand that every business is unique. That’s why we customize our business valuation services to your industry, size, and strategic objectives — whether you’re planning to sell, raise capital, or exit.

Confidential & Reliable

We prioritize discretion. Your financial data and valuation insights remain completely confidential, ensuring you can plan your next move with confidence.

Proven Track Record

We’ve helped countless business owners maximize value, navigate complex M&A transactions, and plan successful exits. Our clients trust us for our expertise, transparency, and results.

Partner with our business valuation experts to get a clear, reliable understanding of your company’s true worth — and make confident, informed decisions.

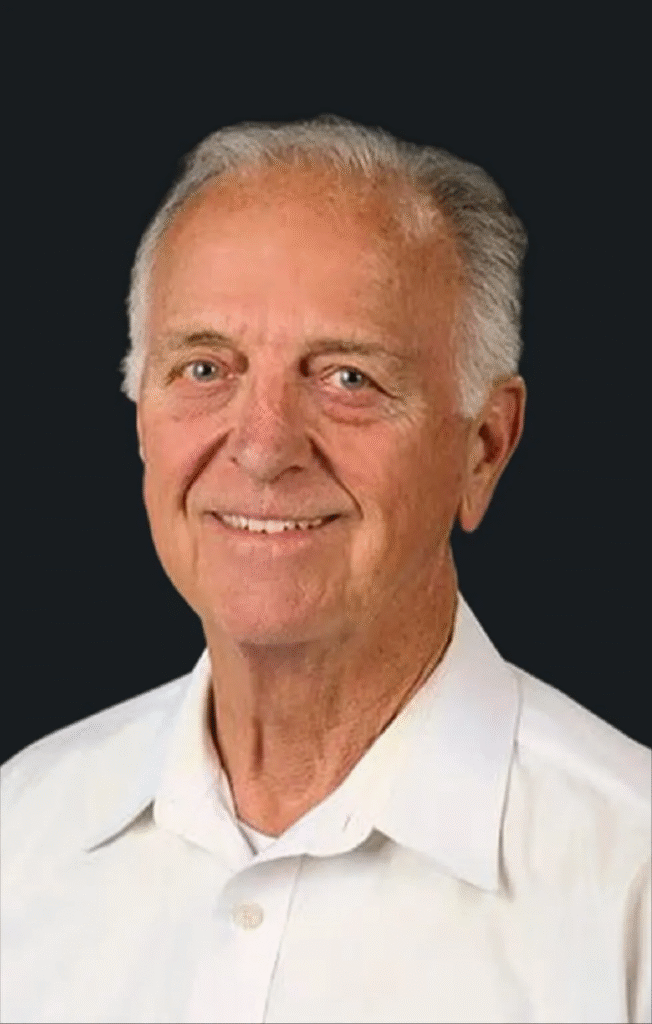

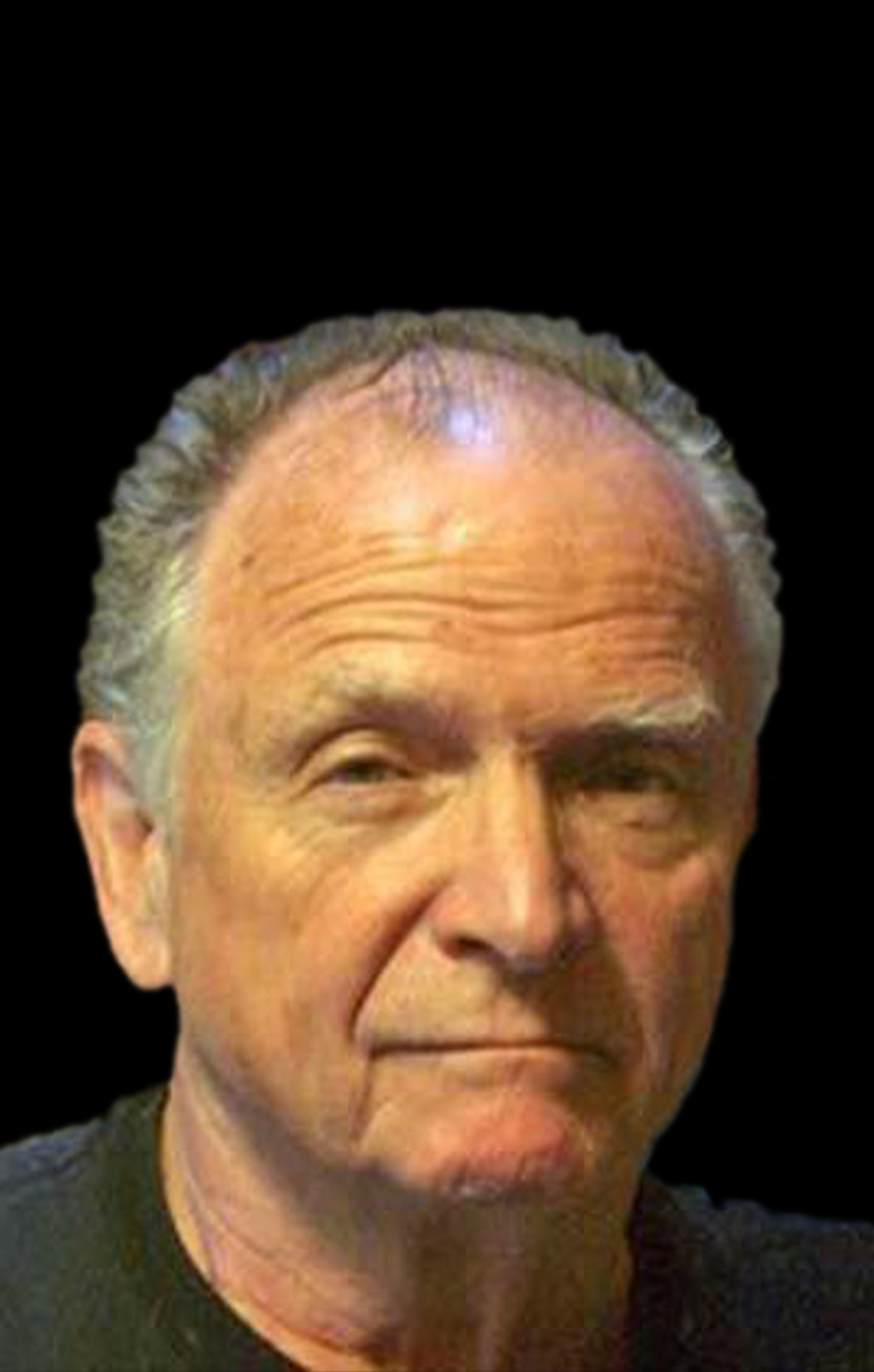

Meet Our Business Valuation Experts

Frequently Asked Questions

1. What is a business valuation?

A business valuation is a professional assessment of your company’s worth. Our business valuation experts use proven methods to calculate value based on financial performance, assets, market conditions, and growth potential.

2. Why do I need a business valuation?

3. How long does the valuation process take?

4. What is needed from me for a business valuation?

To provide an accurate and defensible business valuation, our business valuation experts require key information about your company, including:

Financial statements, tax returns, and balance sheets

Operational data, including employee and inventory details

Contracts, intellectual property, or other significant assets

Information about your growth plans, exit strategy, or sale objectives

Providing complete and up-to-date information ensures our professional business valuation services deliver a report you can trust for selling, exit planning, or strategic decisions.

5. Can I use the valuation report for selling my business?

Absolutely. Our business valuation reports are designed to be defensible and credible, helping you negotiate with buyers, investors, or lenders confidently. They are ideal for business valuation for selling a business and business valuation for exit planning.

6. What influences the accuracy of the valuation?

Several factors affect the accuracy of a professional business valuation, including:

Historical financial performance and cash flow trends

Industry conditions, market demand, and comparable company sales

The quality and completeness of the information provided by the business owner

Tangible and intangible assets, including intellectual property, brand value, or customer base

Growth potential and operational efficiencies

Our business valuation experts analyze all these factors to provide a clear, realistic, and defensible valuation tailored to your business goals.

7. What methods do you use for valuation?

We select the best approach based on your business type and goals:

Market Approach – compares your company to similar businesses recently sold

Income Approach – evaluates projected earnings and cash flow

Asset-Based Approach – assesses tangible and intangible assets

We also offer M&A valuation services for businesses considering mergers or acquisitions.

8. How confidential is the valuation process?

Discover What Your Business Is Really Worth

Get a professional business valuation from certified experts. Plan your sale, exit, or growth with confidence.

Discover What Your Business Is Really Worth

Get a professional business valuation from certified experts. Plan your sale, exit, or growth with confidence.