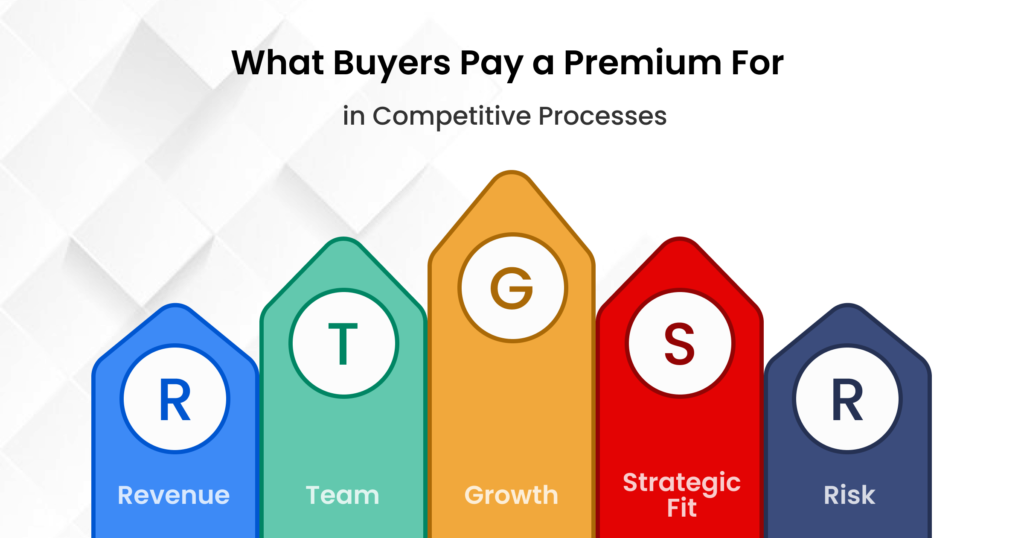

What Buyers Pay a Premium For in Competitive Processes

In competitive sale processes, not all businesses are valued equally—even within the same industry. Some companies consistently attract multiple buyers and premium offers, while others struggle to move beyond average valuations.