Understanding Why Predictable Revenue Drives Higher Valuations in M&A

In today’s M&A market, one trend is remarkably clear:

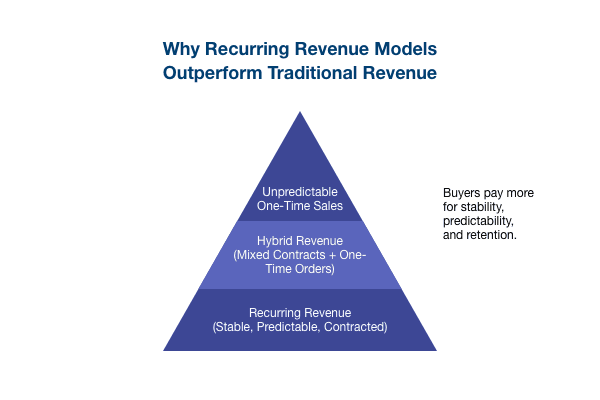

Companies with recurring revenue models are receiving higher valuation multiples than ever before.

Whether it’s SaaS, subscription services, maintenance contracts, memberships, or annual service agreements—buyers are actively competing for businesses that offer predictable, contracted, and recurring income streams.

For sellers, this shift represents a major opportunity.

This guide explains why buyers pay a premium, how recurring revenue impacts your valuation, and what business owners can do to position themselves for a higher exit multiple.

What Exactly Is a Recurring Revenue Model?

Recurring revenue refers to stable, predictable income that repeats on a monthly or yearly basis.

Examples include:

- SaaS subscription (MRR/ARR)

- Membership platforms

- Service contracts

- Retainer-based professional services

- Automatic product replenishment

- Managed services

These models create revenue “locks” that reduce volatility, making them extremely attractive for buyers and private equity firms.

Why Buyers Value Recurring Revenue (And Are Paying More for It)

1. Predictable Cash Flow = Lower Risk = Higher Valuation

In M&A, risk reduction directly increases valuation multiples.

Recurring revenue businesses offer:

- Stable income

- Contracted revenue visibility

- Lower seasonality

- Consistent renewals

This makes forecasting extremely reliable and significantly reduces downside risk.

2. Higher Customer Lifetime Value (LTV)

Buyers love recurring revenue because it creates long-term customer relationships.

When customers stay longer, the LTV increases-meaning the business earns more from each customer over time.

This leads to:

- Higher margins

- Stronger cash flow

- Greater pricing power

3. Lower Customer Acquisition Pressure

Recurring revenue models do not require constant re-selling.

Instead of one-time purchases, revenue compounds.

Buyers are willing to pay more because:

- CAC (Customer Acquisition Cost) is amortized

- Churn can be controlled

- Renewals are cheaper than acquiring new customers

4. Buyers Prefer Revenue That Scales Efficiently

Most recurring revenue businesses-especially SaaS and subscription model-scale without increasing costs proportionally.

This creates:

- High gross margins

- Better EBITDA performance

- Stronger long-term profitability

Buyers can clearly see how the business will grow after acquisition, which increases appetite and valuation.

5. Market Trends Favour Recurring Revenue Models

Across 2024–2025, PE firms and strategic buyers have shifted heavily toward contract-based and subscription-driven companies.

Why?

- They perform better in uncertain markets

- They recover faster during downturns

- They hold or increase valuation multiples even when other industries drop

Recurring revenue isn’t a trend—it’s becoming a core requirement for premium valuations.

How Recurring Revenue Increases Valuation Multiples

Buyers commonly pay a 20%–40% premium for businesses with strong recurring revenue models.

Key valuation benefits include:

✔ Higher EBITDA multiples

Because earnings are stable and predictable.

✔ Stronger acquisition competition

More buyers = higher exit price.

✔ Clear revenue visibility

This enables buyers to forecast future returns confidently and accurately.

✔ Reduced customer concentration risk

Many recurring revenue models pull revenue from a larger base.

✔ Strong renewal and retention rates

Buyers favour businesses with low churn and high customer loyalty.

What This Means for Sellers in 2025

If you own a business with recurring revenue-or can convert part of your revenue into recurring contracts-you are in a highly favourable market position.

This is especially true in:

- SaaS

- IT services

- Managed services

- Healthcare contracts

- Facility management

- Professional services

- Financial services

- Education subscription models

Buyers are actively paying more for businesses that demonstrate:

- Strong retention

- Contracted revenue

- High margin recurring streams

- Low churn

- Annual billing

How to Increase Your Valuation Through Recurring Revenue

Even if your business is not fully recurring, you can add recurring elements to boost valuation:

1. Introduce subscriptions or service plans

Example: annual maintenance, premium membership tiers

2. Convert customers to contracts

Shift one-time buyers into annual agreements.

3. Improve renewal processes

Automate communication, reminders, and engagement.

4. Reduce churn

Enhance customer experience + increase value delivered.

5. Strengthen your LTV/CAC ratio

A strong ratio signals high efficiency to buyers.

Even small changes can dramatically improve exit multiples

Final Takeaway: Recurring Revenue = Higher Valuation and Faster Deals

Buyers are paying more because recurring revenue models offer:

✔ Predictable cash flow

✔ Lower risk

✔ Higher customer lifetime value

✔ Better margins

✔ Faster scalability

✔ Stronger long-term profitability

If your business has a recurring revenue model—or can build one—the M&A market is primed to reward you with higher valuation multiples and faster buyer interest.

Ready to See What Your Business Is Worth?

If you want to understand how much value your recurring revenue model can unlock—or how to strategically build one before selling-request a confidential valuation or exit-readiness assessment today.

Our team will help you:

✔ Evaluate your recurring revenue strength

✔ Identify valuation boosters

✔ Prepare for premium buyer interest

✔ Position your business for a successful, high-multiple exitTake the first step toward maximizing your sale price—reach out to Horizon M&A today.