In today’s M&A environment, many business owners are surprised to learn that buyers are not always valuing companies purely on EBITDA or profits. Instead, especially in technology and services businesses, buyers increasingly rely on revenue-based business valuation to price deals.

This shift reflects how modern businesses grow, scale, and create long-term value. For sellers, understanding why revenue-based valuation models are used, when they apply, and how buyers think about revenue can significantly impact exit timing, valuation expectations, and deal outcomes.

This guide explains how revenue-based business valuation works, why it is common in the tech and services sectors, and what it means for sellers planning an exit.

What Is a Revenue-Based Valuation Model ?

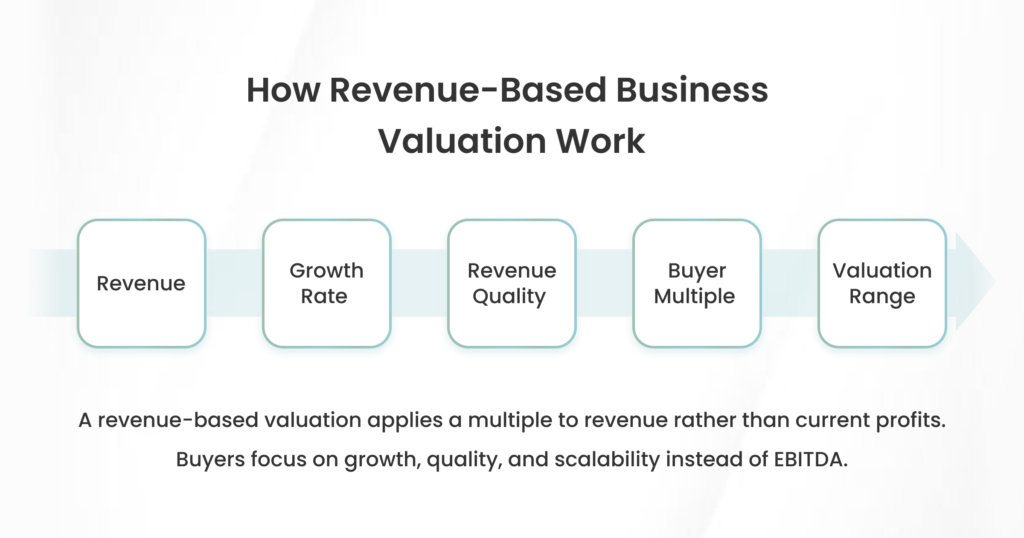

At a high level, how revenue-based valuation works is simple in theory but nuanced in practice. Buyers assess:

- Total annual revenue (ARR, MRR, or trailing 12 months)

- Revenue growth rate

- Predictability and recurrence

- Customer concentration

- Gross margins

- Scalability potential

This approach allows buyers to price companies that are not yet optimized for profitability but demonstrate strong long-term value creation potential.

Revenue-based valuation models are especially common where profitability is intentionally deferred to fund growth, market expansion, or product development.

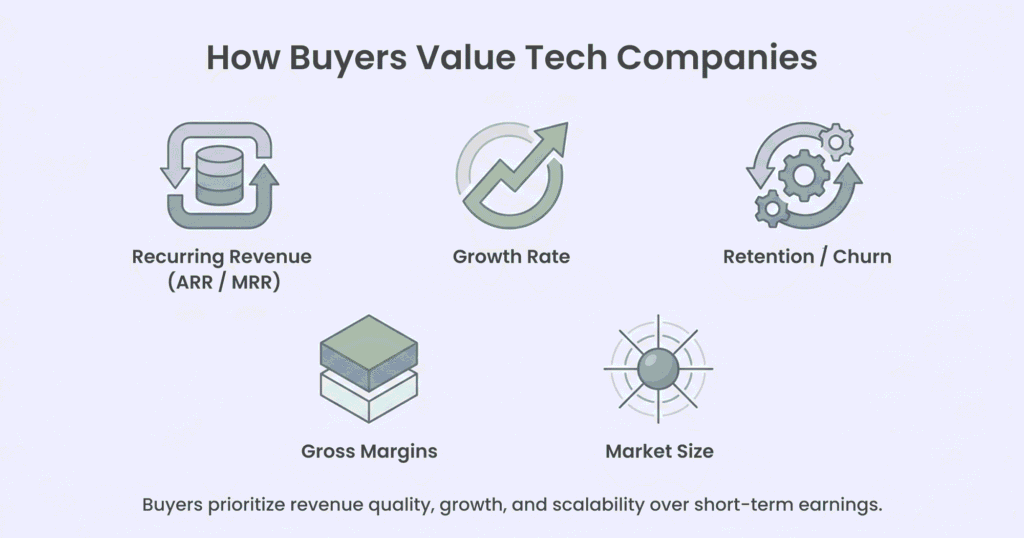

How Buyers Value Tech Companies Today

Modern technology company valuations are driven far more by revenue dynamics than by short-term earnings. In fact, many tech businesses are designed to prioritize scale over profits in their early and mid-growth stages.

When buyers evaluate how buyers value tech companies, they typically focus on:

- Recurring revenue (ARR / MRR)

- Revenue growth velocity

- Customer retention and churn

- Lifetime value (LTV)

- Gross margin profile

- Market size and expansion potential

In tech company valuation, revenue is often the cleanest signal of product-market fit. A fast-growing, recurring-revenue tech company with strong retention may command a premium valuation—even if EBITDA is low or negative.

This is why technology company valuations frequently rely on revenue multiples rather than earnings-based methods.

When to Value a Business Based on Revenue

Not every company should be valued on revenue. Buyers typically choose to value a business based on revenue when profitability does not yet reflect the business’s true potential.

Common scenarios include:

- High-growth companies reinvesting heavily in sales, marketing, or R&D

- SaaS or subscription-based services with strong recurring revenue

- Professional services firms scaling through hiring and expansion

- Businesses transitioning from founder-led to platform-driven models

In these cases, company valuation based on revenue helps buyers price future upside rather than current margin structure.

However, revenue alone is never enough. Buyers still assess whether revenue is:

- Predictable

- Sustainable

- Scalable

- Defensible

Weak revenue quality will not support strong revenue multiples.

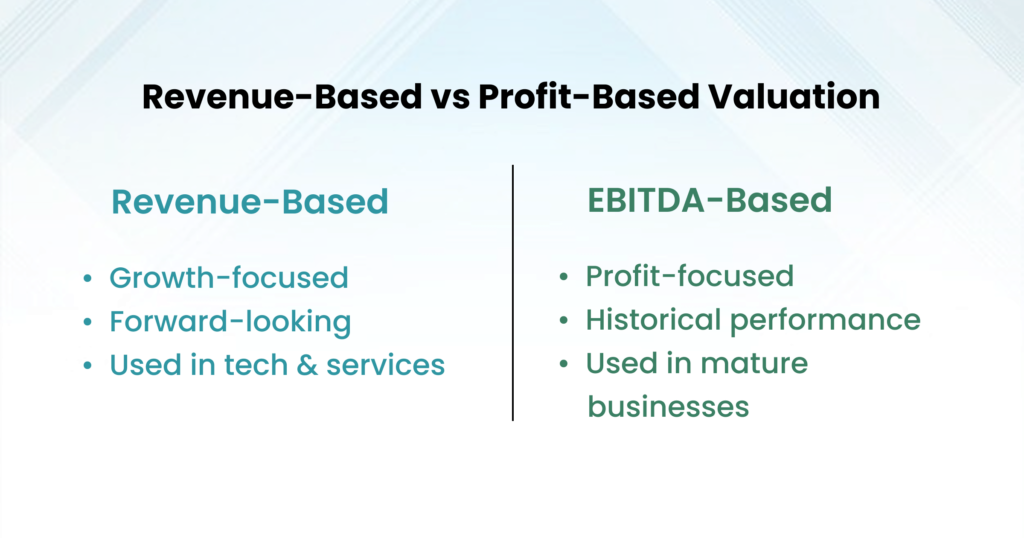

Revenue-Based vs Traditional Business Valuation Methods

Traditional business valuation methods focus primarily on EBITDA, cash flow, or asset value. These models work well for mature, stable businesses with optimized operations.

By contrast, revenue-based business valuation is forward-looking. It emphasizes growth potential rather than current efficiency.

The key difference lies in intent:

- EBITDA-based valuation rewards operational maturity

- Revenue-based valuation rewards scale, momentum, and future earnings potential

In practice, many buyers use a hybrid approach, considering both revenue multiples and earnings metrics to triangulate value.

For sellers, understanding which company valuation method buyers will apply is critical to setting realistic expectations and preparing the business correctly.

Why Tech & Services Businesses Fit Revenue-Based Valuation

Tech and services companies are uniquely suited for revenue-based models because:

- Revenue is often recurring or contract-based

- Margins improve significantly with scale

- Operating leverage increases over time

- Early profitability may be intentionally suppressed

- Growth signals market leadership and defensibility

Buyers view revenue as a proxy for future earnings power. This is why revenue-based valuation has become standard across SaaS, IT services, managed services, digital platforms, and scalable professional services.

What This Means for Sellers Planning an Exit

For business owners, revenue-based valuation changes how you should prepare for a sale.

When buyers rely on revenue-based business valuation, sellers should focus on:

- Improving revenue predictability

- Strengthening recurring revenue streams

- Reducing customer concentration

- Documenting growth drivers

- Demonstrating scalability

- Improving gross margins over time

Understanding business valuation methods for sellers allows you to position your business in the way buyers actually evaluate it—not how sellers assume it should be valued.

Sellers who prepare their revenue story effectively often achieve stronger multiples and more competitive deal processes.

Final Takeaway: Revenue-Based Valuation Rewards Growth, Not Just Profits

Revenue-based business valuation reflects how modern buyers think about value creation—especially in tech and services companies. It rewards growth, predictability, and future earnings potential rather than short-term profitability alone.

If your business has strong revenue momentum but has not yet optimized margins, revenue-based valuation may work in your favour—provided the revenue is high-quality and scalable.

Thinking About Selling? Understand How Buyers Will Value Your Revenue

If you are planning an exit, the first step is understanding which valuation model buyers will apply to your business and how your revenue will be interpreted in a sale process.

A professional valuation can help you determine:

- Whether revenue-based valuation applies to your business

- How buyers will price your revenue

- What improvements could increase your multiple

- When to go to the market for the best outcome

Request a confidential valuation and exit-readiness assessment today and understand the true value of your business in today’s M&A market.