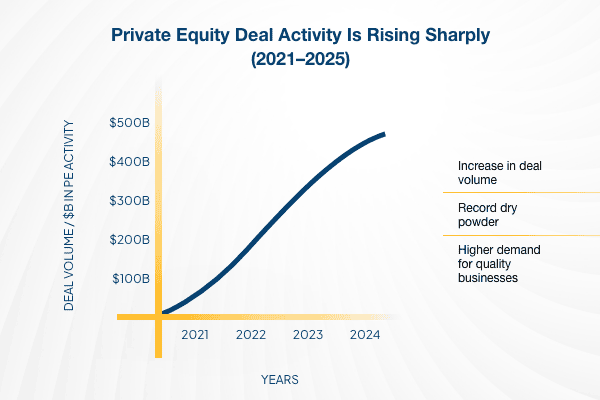

Private equity deal activity has surged sharply in 2025.

This has created one of the strongest seller markets in years. With private equity buyers aggressively pursuing acquisitions, many business owners are asking the same question:

Should I sell my business now, or wait for a better valuation?

In today’s M&A environment, timing your exit strategy is just as important as the deal itself. This guide explains why private equity deal activity is rising, how it influences business valuations, and how sellers can decide whether now is the best time to sell a business.

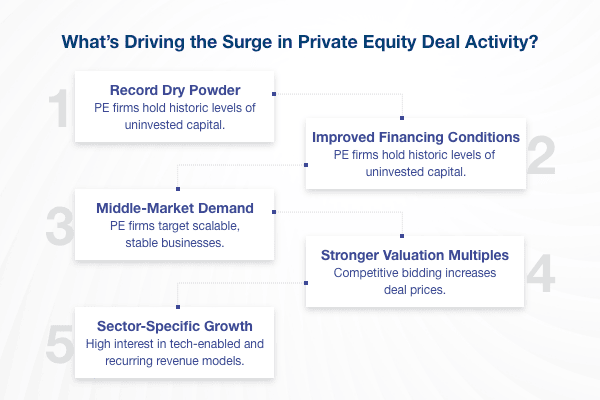

Why Private Equity Deal Activity Is Surging

1. Record Dry Powder Driving Acquisition Pressure

Private equity firms hold record levels of dry powder, and fund managers must deploy capital before fund cycles close. This results in:

- Higher buyer competition

- Better valuations for sellers

- Shorter deal timelines

2. Improved Financing Conditions and Lower Interest Rates

Lower interest rates have revived leveraged buyouts, enabling PE firms to pay stronger multiples.

- More attractive financing

- Higher EBITDA multiples

- Stronger demand for middle-market businesses

3. Middle-Market M&A Is Booming

Most PE deals today are focused on the middle market, typically businesses valued between $5M and $150M.

Why?

- Predictable cash flows

- Scalable operations

- Platform and bolt-on opportunities

What This Surge Means for Sellers

1. Higher Valuations and Stronger Multiples

When private equity deal activity increases, business valuation trends shift upward. Sellers benefit from:

- Higher EBITDA multiples

- Better deal structures

- Faster closing cycles

- Increased competitive bidding

2. Greater Interest in Niche and High-Margin Businesses

PE firms target businesses that show:

- Predictable revenue

- Customer retention

- Scalable operations

This benefits founders in industries like SaaS, manufacturing, healthcare services, and specialty consumer brands.

3. Strong Favorability for Exit Strategies

With buyer demand high, sellers can choose flexible exit structures:

- Full acquisition

- Partial sale (recapitalization)

- Growth equity investments

- Earn-outs with upside

- Founder rollover equity

Should You Sell Now or Wait? A Seller’s Decision Checklist

To determine the best timing, evaluate the following strategic factors:

1. Is Your Business at Peak Performance?

Sell now if:

- Revenue is growing

- Margins are strong

- Customer acquisition is stable

- Operational efficiency is high

If you’re mid-turnaround, waiting could increase valuation.

2. Will Market Conditions Stay Favourable?

Markets can shift. Risks include:

- Interest rate increases

- Inflation pressure

- Election uncertainty

- Sector-specific slowdowns

If risk factors rise in your industry, selling now protects value.

3. Are You Personally Ready to Exit Your Business?

Financial timing matters, but so do personal goals:

- Retirement

- Burnout

- Starting a new venture

- Liquidity needs

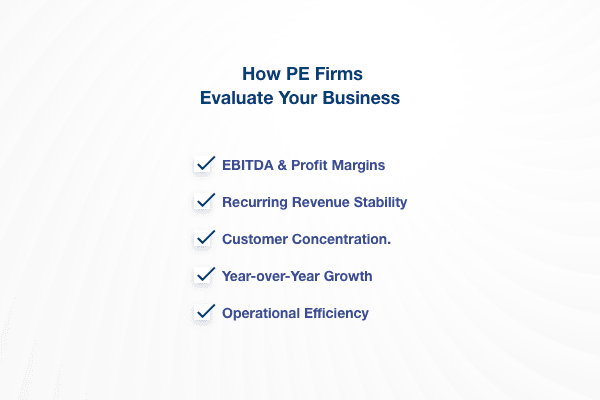

4. Is Your Business Exit-Ready?

You’re more attractive to private equity buyers if you have:

- Clean financials

- Strong management team

- Documented SOPs

- Clear growth roadmap

If these aren’t ready, take a few months to prepare.

What Happens If You Wait?

Potential Advantages:

- More time to grow revenue and increase valuation

- Strengthening operations to reduce risks

- Positioning for emerging market trends

Potential Risks:

- Decreasing valuations if the market tightens

- Higher interest rates reduce buyer appetite

- Competitors becoming more attractive targets

- Economic slowdowns affecting deal flow

Waiting is only beneficial if you have a clear growth path and low market risk.

Expert Recommendation: Sell Now or Wait?

Based on current M&A market trends 2025, sellers are in one of the strongest positions of the last four years. Buyer competition, dry powder, and strong valuation multiples create a favourable selling window.

If your business is performing well and you are exit-ready, selling now can deliver a premium valuation.

If your business needs improvement or you expect major growth soon, waiting may yield even higher returns.

Final Takeaway for Business Owners

Private equity deal activity is surging for structural, not temporary, reasons. Whether you should sell now depends on:

- Market conditions

- Business strength

- Personal timing

- Exit readiness

But one thing is clear — sellers have leverage today, and strong businesses are commanding premium valuations.

If you want to maximize value, the best next step is to get a professional M&A valuation and exit readiness assessment to understand your real market worth. Want a business valuation or exit readiness assessment?

Contact Horizon M&A Advisors today.