Introduction: The Temptation of the First Offer

You’ve built your business from the ground up-years of effort, sleepless nights, and countless decisions that shaped its success. Then, one day, a buyer approaches with an offer. It feels exciting, validating, and maybe even close to what you hoped for.

But here’s the question every business owner should ask:

“Is this really the best offer I can get?”

In mergers and acquisitions (M&A), the first offer can often feel like a golden ticket. Yet, accepting it too quickly might mean leaving significant value on the table. What looks attractive at first could hide risks, unfavorable terms, or missed opportunities.

This article explores why the first offer isn’t always the best-and how business owners can use negotiation strategies to evaluate offers and maximize their business sale outcome.

1. The Psychology Behind the First Offer

The Buyer’s Advantage

Buyers are often strategic. They know sellers can be emotionally invested in their companies. By presenting an early offer-especially one that seems fair-they create urgency and excitement.

This first offer sets what’s known as an “anchor point” in negotiation. Once that number is on the table, it subconsciously influences how you perceive future offers. This is a classic negotiation tactic used in many M&A deals.

Why Sellers Fall for It

Many sellers-especially first-time sellers-see the first offer as validation of their hard work. It feels like recognition. But validation doesn’t equal valuation. A good M&A negotiation strategy helps you step back, evaluate objectively, and avoid rushing into an early commitment.

2. Evaluating Offers Beyond the Price Tag

Look Deeper Than the Number

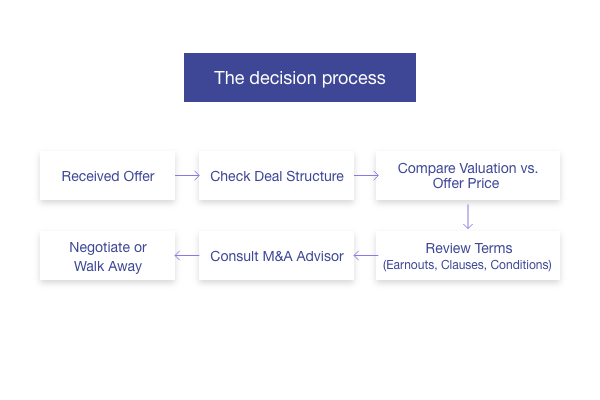

When evaluating offers while selling a business, it’s not just about how much you’re offered-it’s about what’s in the offer. Key elements to review include:

- Deal Structure: Is it an all-cash deal, or does it include earn outs, equity, or deferred payments?

- Offer Terms and Conditions: Are there contingencies or clauses that could impact your payout?

- Buyer Financing: Does the buyer have secure funding or rely on third-party financing?

- Post-Sale Involvement: Will you need to stay on for a transition period, and if so, for how long?

Valuation vs. Offer Price

There’s a big difference between a valuation and an offer price.

Valuation reflects your business’s true worth based on performance and market conditions. The offer price reflects what the buyer is willing to pay-often influenced by their goals, financing, and negotiation position.

An experienced M&A advisor helps bridge that gap by aligning valuation expectations with market reality-ensuring you don’t sell for less than what your business deserves.

3. The Hidden Costs of Accepting Too Quickly

1. Leaving Money on the Table

Accepting the first offer limits your ability to create competition. Without multiple bidders, you lose leverage. Sellers who explore multiple offers often achieve 10–25% higher sale prices on average.

2. Restrictive Clauses

The first offer may come with strings attached-such as earn out clauses, non-compete terms, or performance-based payments that affect your final payout. These can significantly reduce the true value of the deal.

3. Emotional Decision-Making

After years of running your business, it’s natural to feel emotional during the sale. But decisions made under emotional pressure can lead to regret later. One of the best negotiation tips for business owners is to pause and evaluate every term, not just the headline number.

4. The Power of Multiple Offers

Why Multiple Offers Matter

Creating competition among buyers changes the negotiation dynamic. Instead of you chasing offers, buyers compete to win your business-often resulting in a higher valuation and better terms.

How to Handle Multiple Offers for a Business Sale

- Maintain Confidentiality: Keep buyer details private to preserve leverage.

- Set Clear Timelines: Define a window for offer submissions.

- Compare Offers Holistically: Consider deal structure, payment terms, and buyer credibility-not just the price.

- Leverage an M&A Advisor: Professionals handle communications, protect confidentiality, and negotiate strategically on your behalf.

Having multiple offers is one of the most effective business exit negotiation strategies for maximizing value.

5. Negotiation Secrets Every Seller Should Know

Secret 1: Preparation Beats Persuasion

The best negotiators prepare early. Having organized financials, growth projections, and a clear value narrative increases buyer confidence and gives you an upper hand in business sale negotiation.

Secret 2: Know When to Walk Away

Your walk-away point protects you. If a deal doesn’t meet your expectations or includes unfavourable terms, walking away shows strength. Often, buyers return with improved offers.

Secret 3: Use the Letter of Intent (LOI) Wisely

The Letter of Intent (LOI) defines key terms before due diligence begins. Treat it seriously-it sets the foundation for your deal. Review every clause, from pricing structure to exclusivity periods, before signing.

Secret 4: Get Expert Support

A skilled M&A advisor understands buyer psychology, market benchmarks, and negotiation strategy. They ensure your deal structure protects your interests and aligns with your financial goals.

6. Understanding Buyer Psychology in M&A

Every buyer has a motive. Understanding what drives them helps you negotiate effectively.

- Strategic Buyers: Seek synergies, new markets, or competitive advantages. They may pay a premium for a strategic fit.

- Financial Buyers (Private Equity, Investors): Focus on ROI and growth potential. They often negotiate harder on terms but may offer flexible structures.

By understanding buyer psychology in M&A, sellers can position their business as a solution to the buyer’s needs-creating win-win outcomes.

7. When the First Offer Is Worth Considering

Not every first offer should be dismissed outright. Sometimes, the first buyer truly sees your business’s potential and makes a strong, strategic proposal.

In such cases, ensure you still:

- Validate the offer through an independent business valuation

- Review due diligence documents thoroughly

- Compare the deal against industry benchmarks

Even if the first offer is good, taking time to validate it helps you make a confident, well-informed decision.

8. Turning Negotiation into a Strategic Advantage

Negotiation Is Strategy, Not Conflict

Negotiation isn’t about confrontation-it’s about alignment. A strong M&A negotiation strategy seeks balance between what the buyer wants and what you deserve.

Building Win-Win Outcomes

When both parties feel the deal is fair, the transition is smoother and more successful. Skilled negotiators focus on value creation, not just price maximization-ensuring both sides benefit long-term.

Conclusion: Don’t Settle-Strategize

Selling your business is one of the most important financial milestones of your life. The first offer might seem tempting, but in most cases, it’s just the starting point of negotiation-not the finish line.

By evaluating every offer thoroughly, comparing multiple options, and negotiating strategically, you protect the value of your life’s work.

The right deal isn’t just about price-it’s about structure, timing, and peace of mind.

Are you evaluating an offer or planning to sell your business soon?

Connect with our M&A advisory team today – we’ll help you analyze offers, identify hidden value, and negotiate a deal that truly reflects your business’s worth.