Senior ASA Appraiser

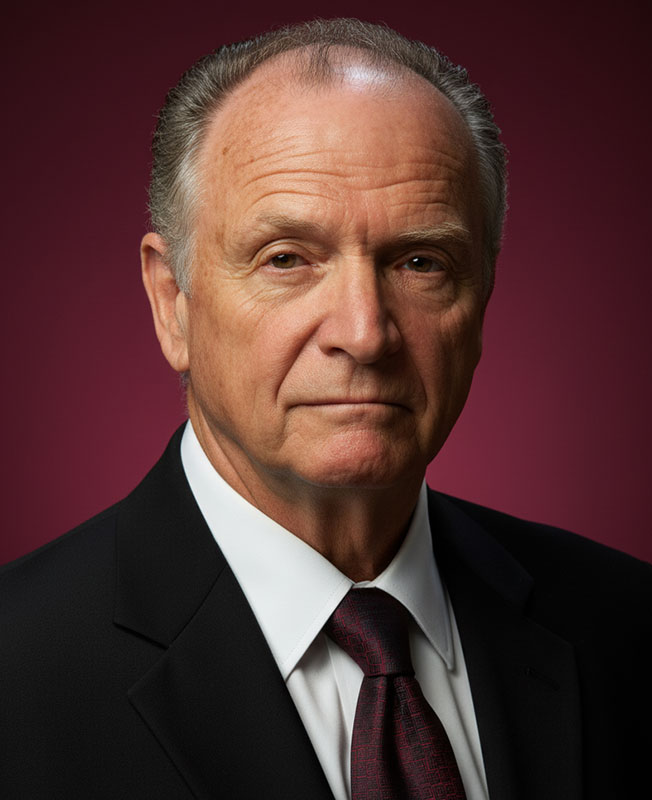

Hans Schroeder

Introduction to Hans Schroeder

(Featured Affiliate)

Since 1987, BEAR has specialized in business valuations nationwide and internationally. We frequently use a team approach in our valuations, including management, owners, M&A advisors, CPAs and attorneys, with the objective of arriving at a fair and reasonable market value.

Our valuations have been done mostly for small to mid-sized companies (up to about $500M sales). We’ve done well over 10,000 valuations with approximately half of these conducted for IRS purposes, with many buy-sell and 409A valuations. Recent examples include construction, SaaS software, clinical-trials stage pharma, distribution companies, independent sales reps, on-line gambling – and hundreds more. Our projection model has provisions for multiple scenarios, and incorporates a number of industry and economic parameters, as well as management input and company financial history.

As BEAR’s senior business appraiser, Hans Schroeder, ASA, is the developer of the proprietary system of software and integrated market data used in every BEAR valuation. Hans has been a business valuation analyst for over 30 years. Before starting BEAR, he was involved in systems and software development for many years, and founded several software companies in Boston, Washington, DC, and California. He authored a software system for commercial credit analysis that was used in over 10,000 banking locations and in over half of the 100 largest banks in the world. Hans has written articles published in valuation journals and has spoken to many professional groups.

Hans has two degrees from MIT, including one in Engineering and one in Quantitative Methods from the Sloan School. He also passed the CPA exam in one sitting (but is not a CPA). He recently took a six-week MIT class in AI Strategy through the Sloan, Computer Science and AI Lab.