In competitive sale processes, not all businesses are valued equally—even within the same industry. Some companies consistently attract multiple buyers and premium offers, while others struggle to move beyond average valuations.

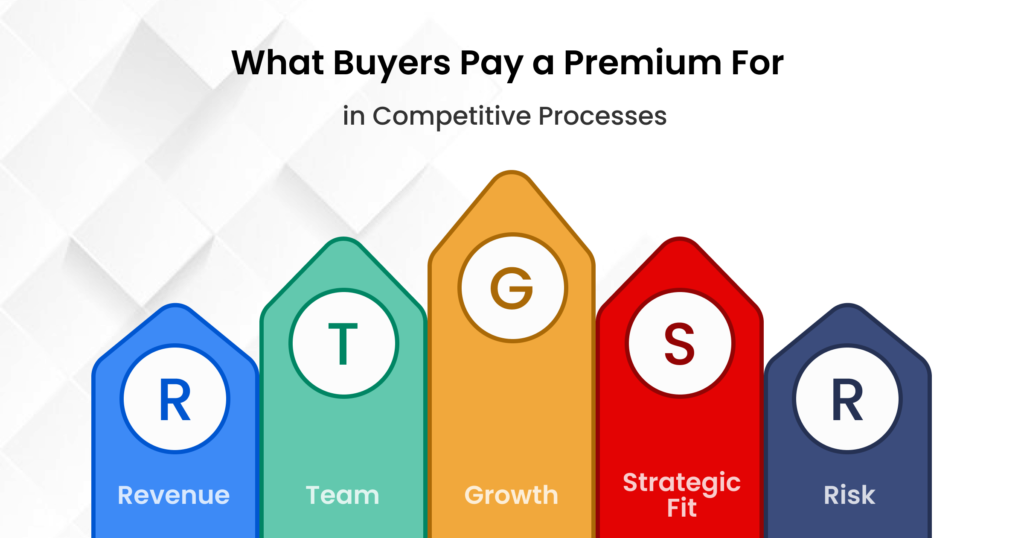

The difference comes down to one critical question: what buyers pay a premium for when competition increases.

When multiple buyers are evaluating the same business, valuation stops being just about numbers and becomes about confidence, risk reduction, and future upside. Understanding these buyer priorities allows sellers to position their business in a way that drives competition and maximizes value.

This guide explains the core buyer valuation drivers, why they matter in competitive processes, and how sellers can prepare to capture premium outcomes.

Why Competitive Processes Create Premium Valuations

A competitive sale process shifts leverage from the buyer to the seller. When buyers know they are not the only option, pricing becomes less conservative and more strategic.

In these situations, buyers pay more when they feel:

- Confident in the sustainability of earnings

- Comfortable with operational and financial transparency

- Urgent about losing the deal to a competitor

- Clear about post-acquisition growth opportunities

Understanding how buyers value businesses in competitive environments helps sellers focus on the factors that truly move price—not just headline revenue or EBITDA.

Predictable, High-Quality Revenue

One of the strongest premium valuation factors is revenue quality. Buyers consistently pay more for businesses with predictable, repeatable revenue streams.

In competitive processes, buyers favor companies with:

- Recurring or contracted revenue

- High customer retention

- Low volatility and seasonality

- Clear revenue visibility

Predictable revenue reduces downside risk. When multiple buyers see the same dependable cash flow, they compete more aggressively, which directly increases valuation.

Strong and Defensible Profitability

While growth matters, buyers pay a premium for profitability that is both strong and defensible. In competitive scenarios, margins act as a credibility signal.

Buyers closely analyze:

- EBITDA consistency over time

- Margin stability

- Cost structure discipline

- Sustainability of add-backs

When profitability is clean and well-documented, buyers are more willing to stretch valuation multiples because fewer assumptions are required to justify the price.

This is a key component of what increases business valuation under competitive pressure.

Clear Growth Story with Evidence

Buyers don’t pay premiums for vague potential—they pay for provable upside. A compelling growth narrative supported by data is one of the most powerful value drivers in a business sale.

Premium outcomes often occur when sellers can clearly demonstrate:

- Identified growth levers already in motion

- Scalable systems and infrastructure

- Market tailwinds and expansion opportunities

- Upside that a buyer can realistically execute

In competitive processes, buyers are willing to pay more when they believe they are acquiring momentum—not just stability.

Low Perceived Risk and Operational Readiness

Risk is the silent killer of premium valuations. In competitive deals, buyers quickly discount businesses where uncertainty exists—even if performance is strong.

Buyers pay more for companies that show:

- Clean financials

- Organized documentation

- Minimal customer concentration

- Clear legal and compliance posture

- Documented processes and SOPs

Operational readiness reduces friction during diligence. The smoother the process feels, the more confident buyers become—and confidence fuels premium pricing.

A Capable, Independent Management Team

Founder dependency limits competition. Buyers pay a premium when they believe the business can operate—and grow—without the owner.

In competitive sale processes, buyers strongly favor businesses with:

- Depth in leadership

- Clear role definitions

- Decision-making beyond the founder

- Continuity post-transaction

A strong management team increases buyer confidence and expands the buyer universe, which directly supports maximizing business sale value.

Strategic Fit and Scarcity Value

Beyond fundamentals, buyers pay premiums when a business fills a strategic gap. In competitive processes, scarcity matters.

Premium pricing often emerges when:

- The business offers unique capabilities

- Geographic or customer overlap creates synergy

- The asset is hard to replicate

- Timing is critical for the buyer

This is why two buyers may value the same business very differently—and why positioning matters so much in competitive deals.

What This Means for Sellers Preparing for a Sale

Premium valuations don’t happen by accident. Sellers who consistently achieve top-tier outcomes focus early on preparing for a competitive sale process.

This involves:

- Improving revenue quality and predictability

- Normalizing and documenting profitability

- Reducing operational and customer risk

- Clarifying growth drivers

- Building management depth

- Preparing diligence materials well in advance

These actions directly support how to get top dollar for your business by increasing competition and buyer confidence.

Business Exit Preparation Is the Real Premium Driver

The businesses that command the highest valuations are rarely the biggest—they are the most prepared.

Thoughtful business exit preparation allows sellers to:

- Control the narrative

- Guide buyer focus toward strengths

- Reduce valuation pressure points

- Create urgency among bidders

In competitive processes, preparation is what turns interest into premium pricing.

Final Takeaway for Business Owners

Buyers pay a premium not just for performance, but for clarity, confidence, and future upside. Understanding what buyers pay a premium for allows sellers to shape outcomes rather than react to them.

When multiple buyers compete, the most prepared business—not the most optimistic seller—wins.

Ready to Maximize Value in a Competitive Sale Process?

If you’re considering a sale, the best time to position your business for premium outcomes is before buyers enter the picture.

A strategic exit preparation review can help you:

- Identify your strongest valuation drivers

- Understand where buyers may discount value

- Prepare for competitive buyer interest

- Position your business to command premium pricing

The right preparation doesn’t just attract buyers—it attracts better offers.

Want Buyers to Pay a Premium for Your Business?

Get a confidential exit readiness review to see how buyers value your business—and what to fix to command top-dollar offers.

Start preparing before buyers set the price.