For many business owners, the most stressful part of selling a company isn’t finding a buyer—it’s surviving due diligence. This is the phase where deals slow down, valuations change, and transactions sometimes fall apart entirely.

Understanding what buyers look for in due diligence is one of the most powerful advantages a seller can have. Buyers don’t enter due diligence hoping to kill a deal—but they do use it to confirm value, uncover risk, and decide whether the price and terms still make sense.

This guide explains what buyers actually find during due diligence, the red flags that raise concerns, and how sellers can prepare properly to protect valuation and close with confidence.

What Is M&A Due Diligence—From a Buyer’s Perspective

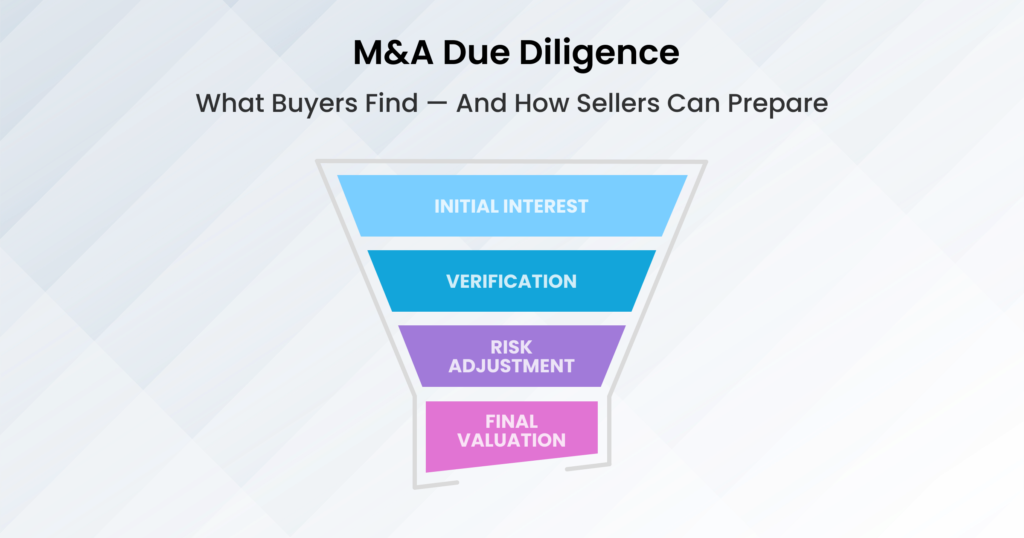

M&A due diligence is the buyer’s process of validating everything that was represented before signing the LOI. It goes far beyond reviewing financial statements. Buyers examine financial integrity, operational maturity, legal exposure, customer stability, and management readiness.

In practice, what buyers find in due diligence determines three outcomes:

- Whether the deal closes

- Whether valuation is adjusted

- Whether terms become more seller- or buyer-friendly

Due diligence is not about perfection. It’s about risk visibility.

What Buyers Look for in Due Diligence

Buyers evaluate businesses across multiple dimensions. While the scope varies by deal, most buyers focus on a consistent core set of issues.

They want to confirm that:

- Financials are accurate and sustainable

- Revenue is real, repeatable, and defensible

- Risks are known, manageable, and priced in

- Operations can scale without disruption

- Management can run the business post-sale

This is why sellers who understand M&A due diligence for sellers often experience smoother processes and fewer surprises.

The Due Diligence Red Flags Buyers Notice Immediately

Some issues raise concern the moment buyers enter diligence. These due diligence red flags don’t automatically kill a deal—but they almost always trigger deeper scrutiny.

Common red flags include:

- Inconsistent or unclear financial reporting

- Aggressive add-backs or unsupported EBITDA adjustments

- High customer concentration

- Poor contract documentation

- Undocumented processes or founder dependency

- Unresolved legal, tax, or compliance issues

When buyers uncover multiple red flags, confidence erodes—and so does leverage.

Due Diligence Issues That Kill Deals (or Trigger Re-Trading)

Not all findings are equal. Some due diligence issues that kill deals outright, while others lead to deal re-trading after the LOI.

The most damaging issues typically involve:

- Quality of earnings issues (revenue recognition, inflated margins, one-off revenue treated as recurring)

- Misstated profitability

- Hidden liabilities or pending litigation

- Weak customer retention or undisclosed churn

- Inability to verify key assumptions

Even when deals survive, these findings often result in risk adjustments in valuation, such as:

- Lower purchase price

- Escrows or holdbacks

- Earn-outs replacing cash

- Stricter representations and warranties

This is where many sellers feel blindsided—because they didn’t anticipate how diligence would impact valuation.

Due Diligence Impact on Valuation: What Sellers Miss

Visual Concept: Valuation Impact Flow

Concept: Risk discovered → Buyer concern → Price adjustment → Deal structure change.

Due diligence doesn’t just validate numbers—it reshapes them. Buyers use findings to recalibrate risk and return expectations.

When diligence reveals uncertainty, buyers respond by:

- Lowering valuation multiples

- Reducing upfront cash

- Shifting risk back to the seller

- Extending closing timelines

In contrast, well-prepared sellers often see:

- Faster diligence cycles

- Minimal re-trading

- Stronger buyer confidence

- Better final terms

Understanding the due diligence impact on valuation helps sellers move from defense to control.

How Sellers Should Prepare for M&A Due Diligence

The best time to prepare for diligence is before you go to market—not after the LOI is signed. Preparing for due diligence is really about removing uncertainty.

Effective seller readiness for due diligence includes:

- Cleaning and normalizing financials

- Preparing a clear quality-of-earnings narrative

- Documenting customer contracts and revenue sources

- Identifying and addressing concentration risks

- Organizing legal, tax, and compliance documents

- Building a professional data room

This approach turns diligence into confirmation rather than investigation.

A Practical Buyer Due Diligence Checklist (Seller View)

From a seller’s perspective, a buyer due diligence checklist typically covers:

- Financial statements and EBITDA reconciliation

- Revenue breakdowns and customer analytics

- Contracts and obligations

- Tax filings and compliance records

- Employee structure and incentives

- Operational systems and SOPs

- Growth assumptions and forecasts

Preparing these items early reduces friction and keeps momentum on your side.

Business Sale Due Diligence Is About Readiness, Not Perfection

Every business has imperfections. What matters is whether those issues are:

- Known

- Quantified

- Explained

- Priced appropriately

Buyers are far more comfortable with transparent risks than with surprises. Sellers who understand how to prepare for M&A due diligence are far less likely to face last-minute renegotiations or failed deals.

Ready to Prepare for Due Diligence—Before Buyers Find the Gaps?

If you’re planning a sale, the smartest move is to assess readiness before entering the market. A professional diligence-readiness review can help you:

- Identify potential red flags early

- Understand valuation risks

- Strengthen your negotiation position

- Reduce the chances of deal re-trading

Contact us to prepare Due Diligence for your business.