In the past, M&A activity was often defined by headline-making mega deals—large, attention-grabbing transactions that transformed entire industries overnight. But in today’s evolving environment, a new strategy is reshaping how buyers pursue growth: programmatic M&A.

Rather than betting everything on one large acquisition, buyers—especially private equity firms and seasoned corporate acquirers—are increasingly choosing to complete a series of smaller, targeted acquisitions over time. This disciplined, repeatable approach to dealmaking has surged across global markets, and it is fundamentally changing how sellers must evaluate their exit opportunities.

For business owners, understanding the rise of programmatic M&A is essential. It affects how buyers value your company, what types of offers you may receive, and how you should position your business to attract the right acquirer.

What Is Programmatic M&A?

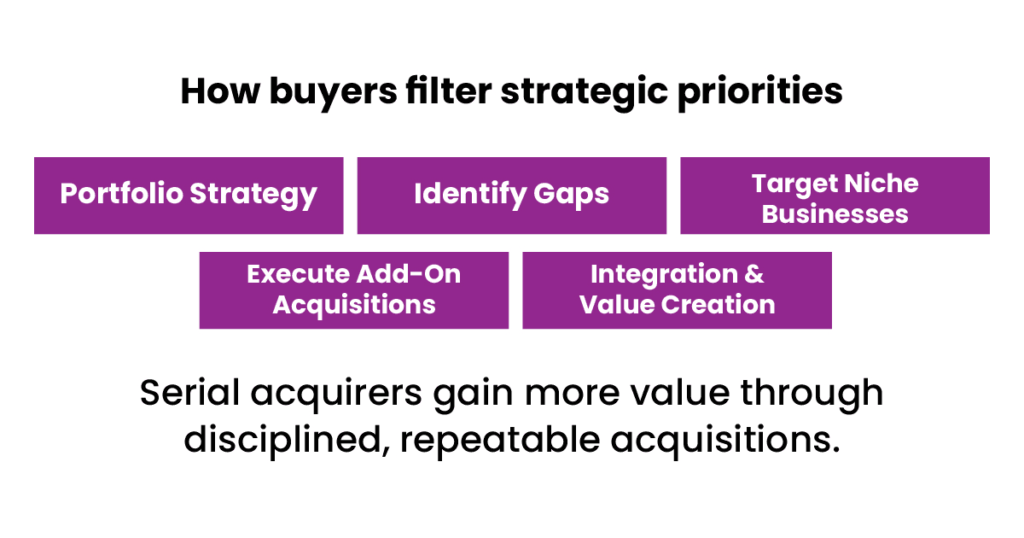

Programmatic M&A refers to a systematic approach where a buyer completes multiple smaller acquisitions, usually within the same ecosystem, instead of pursuing a single transformative deal.

These acquisitions usually target:

- niche capabilities

- small but profitable companies

- add-ons that complement a core platform

- businesses with talent, technology, or geographic expansion potential

Rather than a “big splash,” programmatic M&A focuses on consistent, strategic progress. Companies that use this strategy often become serial acquirers, executing deals every year—even every quarter.

Why Buyers Are Moving Toward Programmatic M&A

1. Lower Risk, Higher Control

Large transactions are expensive and carry heavy integration risks. In contrast, smaller acquisitions reduce exposure and allow acquirers to learn, adapt, and integrate at a steady pace. Programmatic M&A gives buyers more flexibility and more chances to adjust strategy based on real market feedback.

2. Better ROI and More Efficient Capital Deployment

Smaller deals deliver stronger compounding returns. Instead of one giant purchase that may take years to pay off, buyers use capital gradually while seeing returns sooner. This approach aligns closely with private equity models that prioritize predictable, disciplined value creation.

3. Easier Integration and Faster Synergies

Integrating a small business is faster, cheaper, and simpler than integrating a massive organization. Buyers can:

- combine operations smoothly

- adopt technology more easily

- onboard teams with less disruption

- achieve synergies in months, not years

This “low friction growth” is a major reason programmatic M&A has become a preferred strategy.

4. Competitive Advantage in Changing Markets

Markets today evolve quickly. By acquiring multiple companies over time, buyers can rapidly expand capabilities and stay ahead of competitors without needing a single major acquisition to catch up.

What Programmatic M&A Means for Sellers

Why it works:

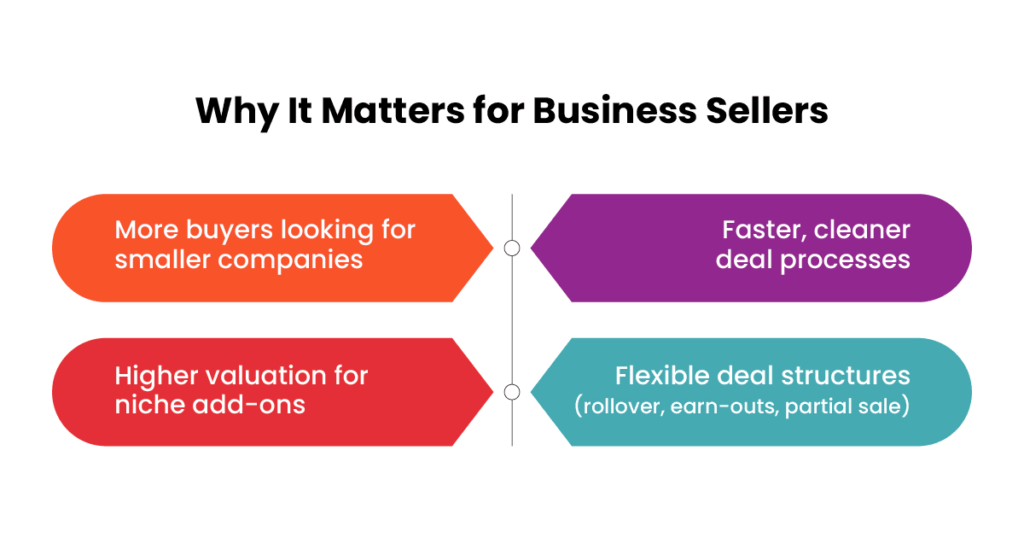

1. More Buyers Looking for Small and Mid-Sized Companies

One of the most important implications for sellers is that demand for smaller, niche businesses has risen sharply. Businesses that once assumed they were “too small to attract buyers” now find themselves in high demand—especially if they offer:

- recurring revenue

- strong customer retention

- specialized expertise

- unique tech or systems

- geographic expansion

- loyal teams and leadership

This means mid-market and lower-middle-market sellers may receive more inbound interest than before.

2. Higher Valuations for “Bolt-On” and “Add-On” Businesses

Serial acquirers look for businesses that fit neatly into their existing platform or ecosystem. If your company enhances their strengths or fills a capability gap, you can command premium valuations.

Examples include:

- niche service providers

- tech-enabled businesses

- recurring revenue models

- high-margin specialized operations

Programmatic buyers often pay more for strategic fit than purely financial buyers.

3. Faster Deal Timelines and Cleaner Processes

Serial acquirers are experienced. They have:

- established play books

- streamlined due diligence

- clear integration plans

- specialized acquisition teams

This means sellers often benefit from faster closing periods, less friction, and smoother transitions.

4. More Flexibility in Deal Structures

Unlike one-off buyers, serial acquirers offer diverse deal options, such as:

- partial sale / recapitalization

- staged earn-outs

- rollover equity

- long-term leadership opportunities

- incentive-based growth plans

For founders who want to stay involved, scale the company, or create a second exit, this flexibility can be extremely valuable.

5. Better Long-Term Outcomes for Employees and Customers

Programmatic acquirers understand integration and culture. They often prefer:

- keeping teams intact

- preserving customer relationships

- maintaining brand presence

- investing in growth

This results in a smoother post-acquisition transition and better continuity for all stakeholders.

How Sellers Can Position Themselves for Programmatic Buyers

To attract programmatic acquirers, businesses should focus on:

- clearly demonstrating strategic fit

- showing predictable recurring revenue

- strengthening margins and cash flow

- documenting processes and SOPs

- building a capable second-level leadership team

- reducing risk (customer concentration, legal, compliance)

These elements make your business easier to integrate—exactly what serial acquirers look for.

Final Takeaway: The Rise of Programmatic M&A Is a Major Opportunity for Sellers

The shift toward programmatic M&A is not temporary—it represents a long-term change in how growth-focused buyers operate. For sellers, this trend opens doors to more buyers, better valuations, and faster, more flexible deal structures than traditional M&A.

If your business offers niche capabilities, recurring revenue, strong operations, or even a loyal local customer base, you may be more attractive to buyers than ever before—especially in a market where serial acquirers are actively searching for the right add-ons.

Thinking About Selling? Understand How Programmatic Buyers See Your Business

If you want to know how your company fits into this new M&A landscape—and whether programmatic acquirers would pay a premium for your business—request a confidential valuation and buyer-readiness assessment today.Take the first step toward your best exit—connect with Horizon M&A.