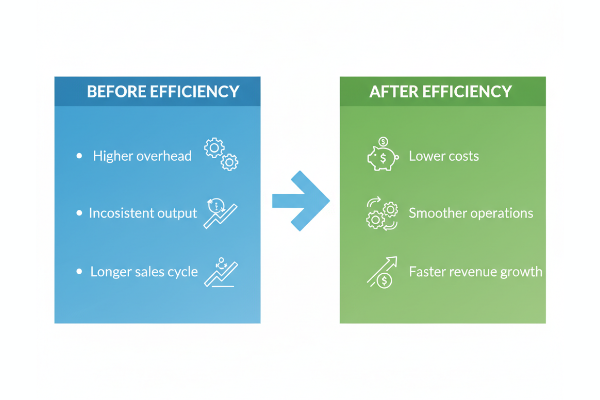

When business owners think about selling their company, the focus often lands on revenue growth, profitability, and market share. But there’s a hidden driver of value that many overlook: operational efficiency.

Buyers don’t just pay for what your company earns today — they pay for how smoothly it can operate tomorrow without unnecessary risks or costs. If your business is bloated with inefficiencies, buyers will discount their offers. But if you’ve streamlined operations, documented systems, and reduced waste, buyers are often willing to pay higher M&A multiples.

So the question for sellers becomes: How can operational efficiencies unlock hidden value and lead to a more profitable exit?

Why Operational Efficiency Matters in M&A

In the M&A process for business owners, buyers assess more than financials. They look at how the business runs on a day-to-day basis and whether it can scale.

Key reasons buyers reward efficiency:

- Lower risk: Fewer operational bottlenecks reduce dependency on the founder.

- Predictable margins: Streamlined processes create consistent profitability.

- Scalability: Efficient systems can handle growth without significant added cost.

- Integration ease: Acquirers want businesses that can merge seamlessly into their existing operations.

For sellers, this means that unlocking hidden value through operational improvements can directly translate to better deal terms and a higher exit price.

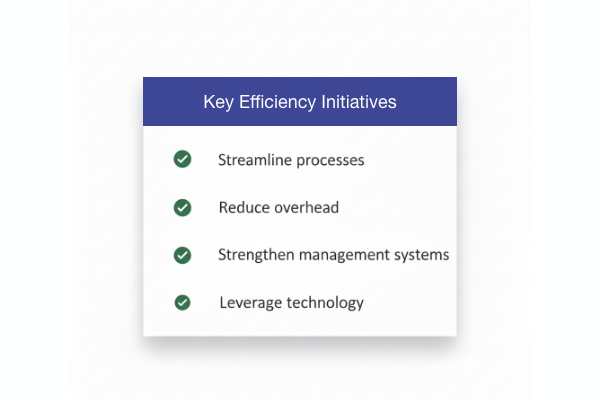

Steps to Improve Operational Efficiency Before a Sale

Step 1: Strengthen Financial and Operational Transparency

The first step in improving efficiency is ensuring that buyers can easily understand your numbers. Nothing erodes trust faster than messy or unclear reporting.

- Standardize financial reporting with clear revenue, cost, and margin breakdowns.

- Document operating procedures so buyers know how key functions are managed.

- Centralize data to make due diligence smoother.

When buyers see a company with strong reporting discipline, they’re more likely to value it higher because they perceive less risk

Step 2: Optimize Cost Structures Without Cutting Corners

Many entrepreneurs equate efficiency with aggressive cost-cutting, but buyers are wary of businesses that compromise quality for savings. Instead, focus on:

- Process automation (reducing manual work and errors)

- Vendor consolidation to lower procurement costs

- Energy and resource efficiency for sustainable cost savings

- Inventory optimization to free up working capital

These operational upgrades signal to buyers that the business runs lean while still maintaining quality — a combination that commands higher multiples.

Step 3: Reduce Founder Dependency

One of the biggest risks in business exit strategies is overreliance on the owner. If the business can’t operate without you, buyers will discount the price or demand earn-outs.

To fix this:

- Build a capable management team that can run day-to-day operations.

- Delegate client relationships and decision-making authority.

- Create knowledge transfer systems so processes don’t live only in your head.

The less dependent the business is on you, the more transferable and valuable it becomes.

Step 4: Improve Operational Scalability

Buyers often pay a premium for businesses that can grow without significant added costs. Scalability is a signal of future profitability.

Ask yourself:

- Can my business handle a 20–30% growth surge without breaking systems?

- Are operations standardized enough to be replicated across locations or markets?

- Do I have the right technology stack to support scaling?

A scalable company not only attracts more buyers but also drives higher M&A valuations.

Step 5: Leverage Technology for Efficiency Gains

Modern buyers expect technology-driven businesses. Automating repetitive tasks, streamlining customer service, and using analytics to optimize operations make your company more attractive.

Examples of efficiency-boosting technology:

- ERP systems for resource planning

- CRM tools to strengthen customer relationships

- AI-powered analytics for better decision-making

- Cloud solutions for flexibility and scalability

Technology investments often deliver a strong return during M&A because buyers view them as future-proofing the business.

Step 6: Benchmark Against Industry Standards

To command top multiples, your business must not only be efficient but also competitive. Benchmark your performance against industry averages for:

- Gross margins

- Operating costs

- Inventory turnover

- Customer acquisition cost vs. lifetime value

If your metrics outperform the industry, buyers are more likely to pay a premium. If you’re underperforming, improving these benchmarks before going to market can maximize business value before sale.

Step 7: Showcase Efficiencies During the Sale Process

It’s not enough to make improvements — you must highlight them during the M&A process.

- Provide buyers with efficiency reports and benchmarks.

- Showcase process improvements in your confidential information memorandum (CIM).

- Demonstrate how efficiencies have boosted profitability over time.

Positioning operational improvements as part of your growth story ensures buyers recognize — and reward — the hidden value you’ve built.

Common Mistakes Sellers Should Avoid

Even with the best intentions, some sellers reduce value by mishandling efficiency improvements.

- Cutting too deep: Sacrificing product quality or employee morale in the name of efficiency.

- Last-minute fixes: Buyers see through rushed changes just before a sale.

- Neglecting documentation: Improvements that aren’t well-documented lose credibility.

Avoiding these mistakes ensures your efforts translate into tangible deal value.

Conclusion: Operational Efficiencies Unlock Premium Valuations

In M&A, operational efficiency is often the hidden driver of value. While revenue and profitability are critical, buyers increasingly look at how well a business runs behind the scenes.

For sellers, streamlining operations, reducing dependency on the founder, and investing in scalable systems can transform an average offer into a premium valuation.

At Horizon M&A, we provide expert sell-side M&A advisory to help business owners uncover these hidden value drivers and position their companies for higher M&A multiples. Whether you’re considering selling soon or just starting to prepare, our team delivers the guidance you need to maximize value and exit on your terms.👉 Ready to unlock hidden value in your business? Contact our M&A advisory team today to explore how operational efficiencies can drive a smarter, more profitable exit.